This work is licensed under a Creative Commons License.

To the left is a list of reporting entities who have provided a specific disclosure in their XBRL-based digital financial report. Click on the name of the entity and the disclosure will show up on the right. For more information please concact CharlesHoffman@olywa.net or go to http://xbrl.squarespace.com/journal/2014/12/21/understanding-primary-cause-of-errors-in-public-company-sec.html.

Maturities of Long-Term Debt

The following pieces fit together to provide information about long-term debt which can sometimes include capital leases as part of long term debt:

There are two issues which make detecting concepts challenging. The first is getting the correct matching sets of current and noncurrent concepts. The second is the correct set of debt (long term debt, capital lease obligations, long term debt and capital lease obligations). This creates numerous permutations of the combinations of concepts. Many of these seem irrational. The impute rules need to be adjusted to improve the algoritym.

The following are visual images of the four pieces described above using Best Buy which conforms to 100% of what is expected:

Balance sheet line items:

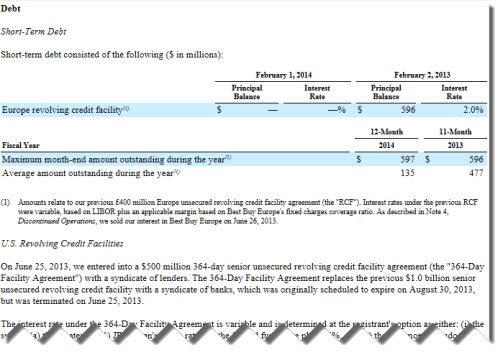

Debt note (combines short and long-term debt):

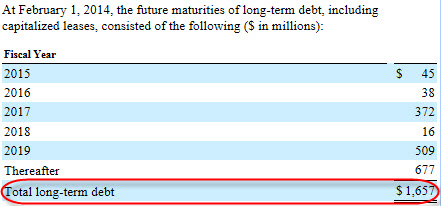

Maturities of long-term debt:

Long-term debt instruments:

This work is licensed under a Creative Commons License.